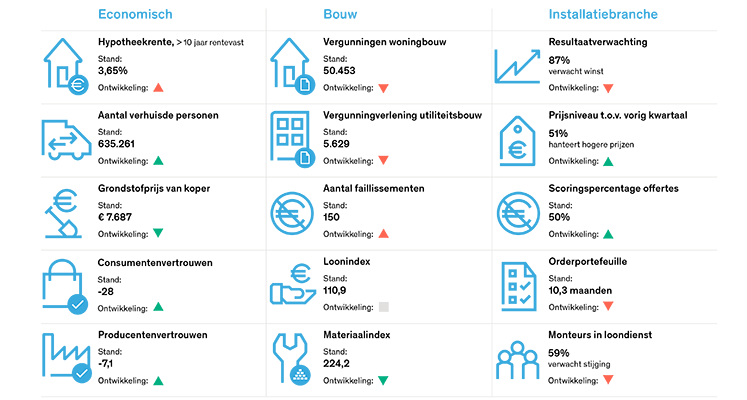

The Economic Dashboard Installation Industry for the first quarter of 2024, published by Techniek Nederland, shows a stable picture of expectations compared to the previous quarter. The anticipated contraction in construction output in 2024 affects work in new construction for the installation industry. This is offset by high demand in renovation and maintenance for energy-saving measures.

The construction industry is gearing up for a down year. Total construction output is expected to shrink by 2024. Rising construction costs and increased interest rates have contributed to this. It will not be the free fall previously predicted by economists, but declining construction activity should be taken into account. This is also reflected in the number of permits issued. The decline for the number of permits is greatest for residential construction at 9.3% while the damage for non-residential construction remains relatively limited with a 4.9% decline.

In the long term, residential and non-residential construction production is expected to stabilize with tentative signs of recovery in 2025. This is due to the now improved economic conditions, such as stabilizing interest rates and rising incomes. Furthermore, new construction production is increasingly composed of rental housing and the share of owner-occupied housing is decreasing. This means a shift in overall production toward (smaller) multifamily housing.

Finally, construction market trends continue to have a significant impact on the installation sector. Trends in energy-saving measures for existing construction continue unabated as few new buildings are sold.

Stable outlook installation industry

As in the previous quarter, the amount of orders yet to be executed is equivalent to about 10 months of work. Revenue expectations and quote requests are also not much different from the previous quarter. Most respondents expect positive earnings expectations, although there is a notable difference, with a fair proportion of respondents expecting losses of less than 5%. This is a 6% change from 0% last quarter. All in all, current trends in the installation industry are fairly stable, except that expectations for both maintenance and renovation are more positive than new construction.

The expectations of the installation sector are a translation from the business survey, which Techniek Nederland conducts quarterly among installation companies with more than 25 employees. Participants in this survey receive a report setting out their expectations against the expectations of industry peers.